M. FRANKLIN PARRISH

Married Client Trust Tax Savings Provisions

It is important to understand that not all Trusts are drafted correctly. In many cases, “you get what you pay for.” Such Trusts frequently are “one size fits all” and contain “estate planning traps” in Revocable Living Trusts. Such “traps” include various inappropriate tax clauses, as well as “boilerplate” administrative provisions. At this juncture, you may be thinking: “Well, if these are the ‘traps’, then what are the appropriate provisions to include or look for in my Trust?”

Please also recall most clients have an inherent fear or misunderstanding of Trusts. Many believe a Trust will tie their hands and they will lose control. However, if properly drafted neither result will occur. As a general rule, my approach is to first alert clients to what estate planning options they have available, without “becoming an IRS test case”, and then to help them make informed decisions. Please understand the use of a Revocable Living Trust with appropriate tax savings provisions is only one in a series of estate planning documents.

For a married couple with a net worth in excess of $24,120,000 (including life insurance), it makes tax sense to include within a Revocable Living Trust the following three (3) “Sub-Trusts”:

- A Survivor’s Trust,

- A Family Exemption Trust, and

- A QTIP (Qualified Terminable Interest Property) Marital Trust.

These Trusts may appear under various names including an “A, B, C Trust Plan”. Likewise, in community property states (i.e. California, Washington, Idaho, Nevada, Arizona, New Mexico, Texas and Louisiana), all of the above “Sub-Trusts” are generally included in one Trust Agreement. However, in common law states (i.e. the other forty-two), each spouse has his or her own separate Trust Agreement, and generally contained within it are the following two (2) “Sub-Trusts”:

- A QTIP (Qualified Terminable Interest Property) Marital Trust, and

- A Family Exemption Trust.

The tax formulas in this type of Revocable Living Trust should annually adjust, taking into account increases in the Unified Credit, also known as, “Applicable Exclusion Amount”. As of January 1, 2022, the “Applicable Exclusion Amount” was $12,060,000 and is now annually adjusted for inflation.

Please remember the following points regarding asset allocation at the death of the first spouse.

-

The Survivor’s Trust remains revocable, and is funded with the surviving spouse’s separate property and that spouse’s one-half (Y,) interest in any community property.

-

The Family Exemption Trust becomes irrevocable, and is funded with the deceased spouse’s separate property and that spouse’s one-half (Y,) interest in any community property up to a limit of the “Applicable Exclusion Amount” (i.e., in 2022 the amount is $12,060,000 as annually adjusted for inflation).

-

The QTIP (Qualified Terminable Interest Property) Marital Trust becomes irrevocable, and is funded with the deceased spouse’s asset values in excess of the “Applicable Exclusion Amount” noted above.

Also understand, The Revocable Living Trust does not just continue to operate on “automatic pilot” following the death of the first spouse. The Successor Trustee, in most cases the surviving spouse, has a series of meticulous fiduciary duties to perform including, but not limited to valuation of all assets, as well as allocation and retitling of all assets among the various “SubTrusts”. The details of post-mortem Trust administration will be addressed in a separate article.

There should be no federal estate tax due following the death of the first spouse. Some clients take a carefree approach to fiduciary duties. DON’T! I repeatedly advise clients, “The death of the first spouse is a ‘dress rehearsal’ for all the tax filing requirements at the surviving spouse’s death,”if the estate exceeds the “Applicable Exclusion Amount” (i.e., $12,060,000 in 2022). For a married couple that amount is $24,120,000, as adjusted for inflation, and for a single client, the amount excluded from federal estate taxation is $12,060,000. In addition, the IRS will likely review the valuation and allocation procedures undertaken at the death of the first spouse. Therefore a word to the wise, “Keep well-organized and accurate records.”

What follows is a summary of the maximum rights a surviving spouse, as sole beneficiary, may possess under each “Sub-Trust”, while acting as Successor Trustee and still achieve the desired result of avoiding unnecessary federal estate taxation:

- The Survivor’s Trust:

- The right to all annual income,

- The right to all principal, and

- The right to give the assets to anyone the surviving spouse so desires during his or her lifetime, or at date of death (i.e. a General Power Of Appointment).

- The Family Exemption Trust:

- The right to all annual income,

- The right to additional principal based on an IRS “ascertainable standard”. This standard includes distributions for a surviving spouse’s “health, education, support and maintenance”. These are the four (4) magic words in the Regulations.

- The right to give the assets to anyone, the surviving spouse so desires during his or lifetime or at date of death, to the exclusion of the surviving spouse, his or her creditors, or the creditors of the surviving spouse’s estate (i.e. a Special Power Of Appointment).

- The QTIP (Qualified Terminable Interest Property) Marital Trust:

- The right to all annual income,

- The right to additional principal based on an IRS “ascertainable standard”. This standard includes distributions for a surviving spouse’s “health, education, support and maintenance”.

- The right to give the assets to anyone, the surviving spouse so desires during his or lifetime or at date of death, to the exclusion of the surviving spouse, his or her creditors, or the creditors of the surviving spouse’s estate (i.e. a Special Power Of Appointment).

I continue to believe the most difficult issues in estate planning are not tax related, but personal in nature. Therefore, each estate plan if properly done, must reflect your personal desires. However, do not ignore the obvious, and have included in your Revocable Living Trust the “appropriate provisions” listed above.

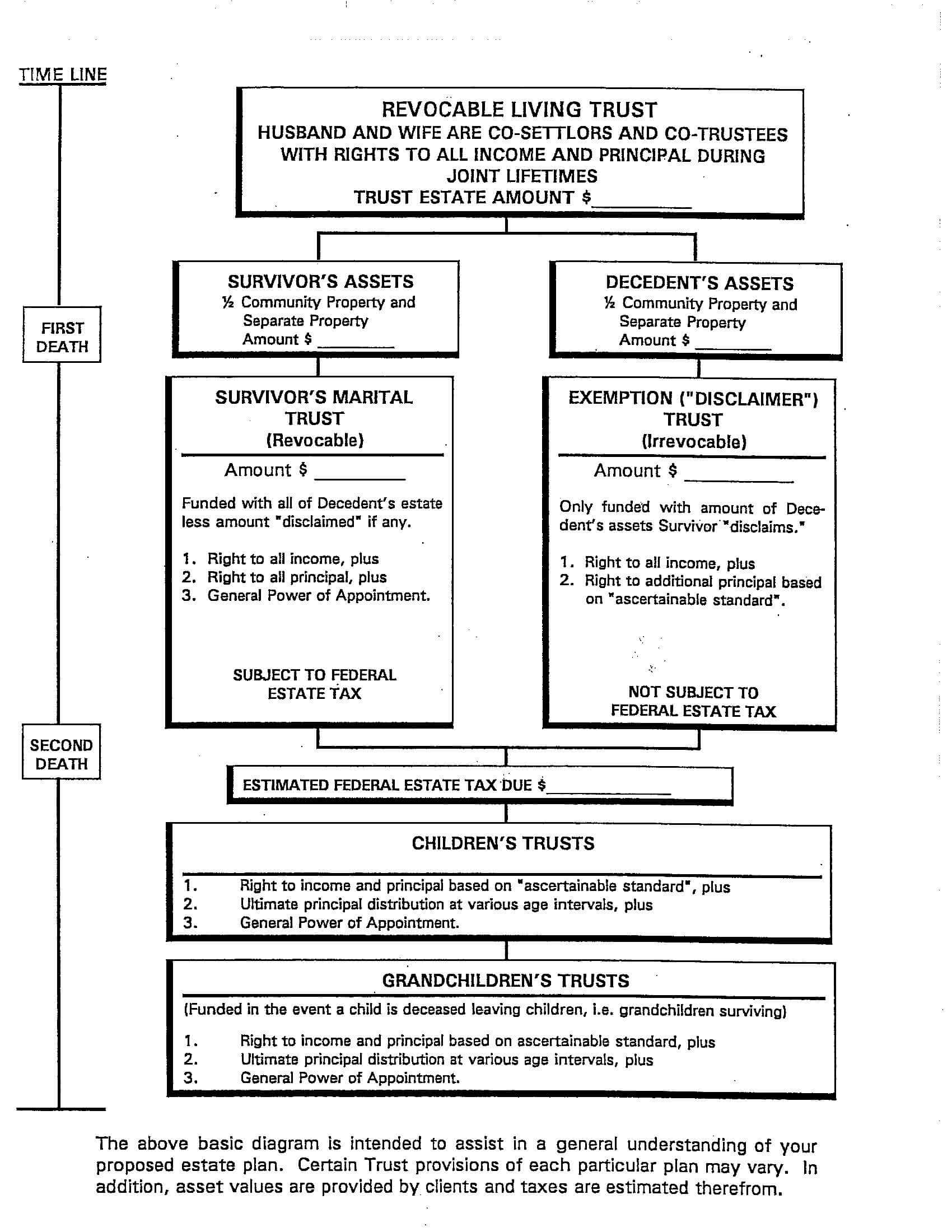

For a better understanding of a Revocable Living Trust which contains a Survivor’s Marital Trust, a QTIP (Qualified Terminable Interest Property) Marital Trust, and the Family Exemption Trust, please review the flowchart which follows this article.