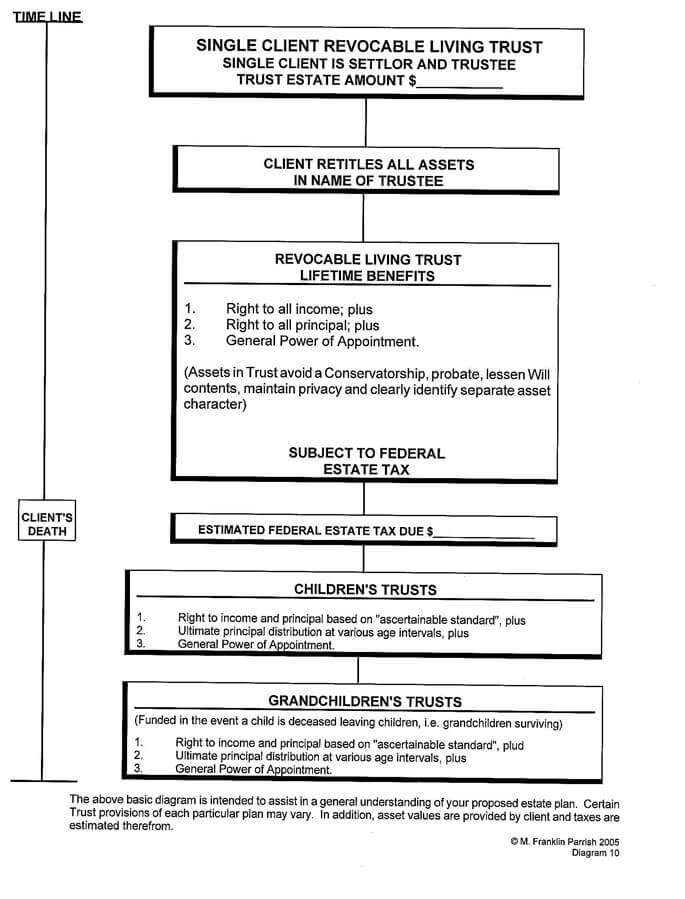

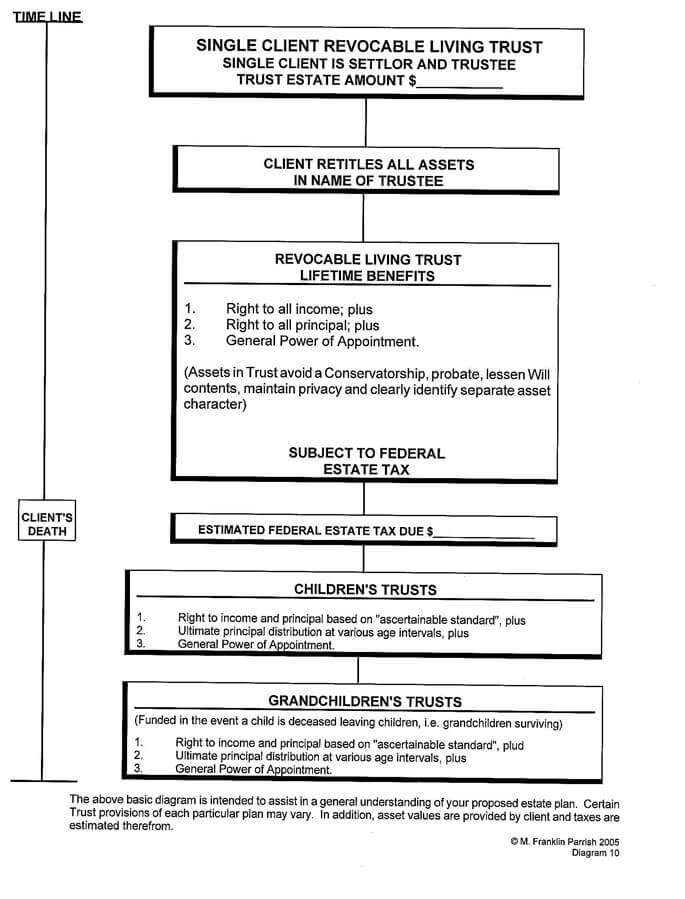

TRADITIONAL ESTATE PLANNING FOR SINGLE INDIVIDUAL

WITH A NET WORTH UNDER $12.060,000

For a single individual with a net worth under $12,060,000 or less, the most flexible estate plan will often include the following documents:

- Revocable Living Trust/Restatement Of Trust: includes provisions to maintain privacy, sub-trusts established for beneficiaries, avoid problems in asset management in the event of incapacity, and avoids probate.

- Pour-Over Will: governs any assets not transferred into The Revocable Living Trust. If the individual was previously married and has minor children the Will should include an article appointing Guardians for minor children, as well as to include specific burial instructions and anatomical bequest.

- Durable Power Of Attorney: avoids the need of a court supervised Conservatorship in the event of incapacity. However, the Durable Power Of Attorney only governs assets not titled in a Trust (e.g., retirement plans). In addition, a Durable Power Of Attorney terminates immediately upon the death of the principal (e.g., the creator of the Durable Power Of Attorney).

- Advance Health Care Directive: grants to another individual the authority to make health care decisions in the event you are unable to make the same. This document replaces all prior health care documents and also contains a Durable Power of Attorney for Health Care, as well as a designation of your primary physician.

- Property Status Agreement: defines the character of all property interests for federal income taxation purposes. It also converts joint tenancy property into community property.

- Assignment of Tangible Personal Property: general documentation to reflect your objective that investments of various kinds (i.e., antiques, collectibles, household possessions, jewelry, etc.), are considered as Trust assets, and not subject to probate. It is guaranteed to avoid probate of such assets.

- Assignment of Intangible Personal Property: general documentation to reflect your objective that investments of various kinds (i.e., marketable securities, mutual funds, closely-held businesses interests, etc.), are considered as Trust assets, and not subject to probate. It is no guarantee it will work, but at least it manages the client’s intent to avoid probate.

The center piece of this estate plan is a Revocable Living Trust. The $12,060,000 figure is utilized because under the current law, each U.S. Citizen is entitled to an exclusion from federal estate taxation equal to the above Dollar amount. It is also annually adjusted for inflation. In 2022, the Applicable Exclusion Amount is $12,060,000.